Child Tax Credit: File your 2021 taxes, even if you had $0 in income, + local resources for tax help for low-income families

At a press conference Feb. 11, 2022 encouraging people to file 2021 income tax returns: (pictured from left) Congresswoman Rep. Mary Gay Scanlon; Jonathan Barnes, Campaign for Working Families Director of Volunteer Engagement; Edward Coleman, Community Action Agency of Delaware County (CAADC) CEO; Frances Sheehan (at podium), Foundation for Delaware County President; Elisha Arnold Coffey, Voices for Children Coalition Advocacy Director; and Dr. Monica Taylor, Delaware County Council Chair.

(Feb. 11, 2022)

MEDIA - It's tax time, and it's especially important to file your 2021 tax return, even if you had $0 in income.

Congresswoman Mary Gay Scanlon held a press conference Feb. 11 at the Delaware County Courthouse in Media to encourage Pennsylvanians to complete a tax return this year in order to receive their full Child Tax Credit benefits. Providing brief remarks were (pictured from left) Rep. Scanlon; Jonathan Barnes, Campaign for Working Families Director of Volunteer Engagement; Edward Coleman, Community Action Agency of Delaware County (CAADC) CEO; Frances Sheehan (at podium), Foundation for Delaware County President; Elisha Arnold Coffey, Voices for Children Coalition Advocacy Director; and Dr. Monica Taylor, Delaware County Council Chair. A 17-minute video of the press conference is on Delaware County's YouTube page.

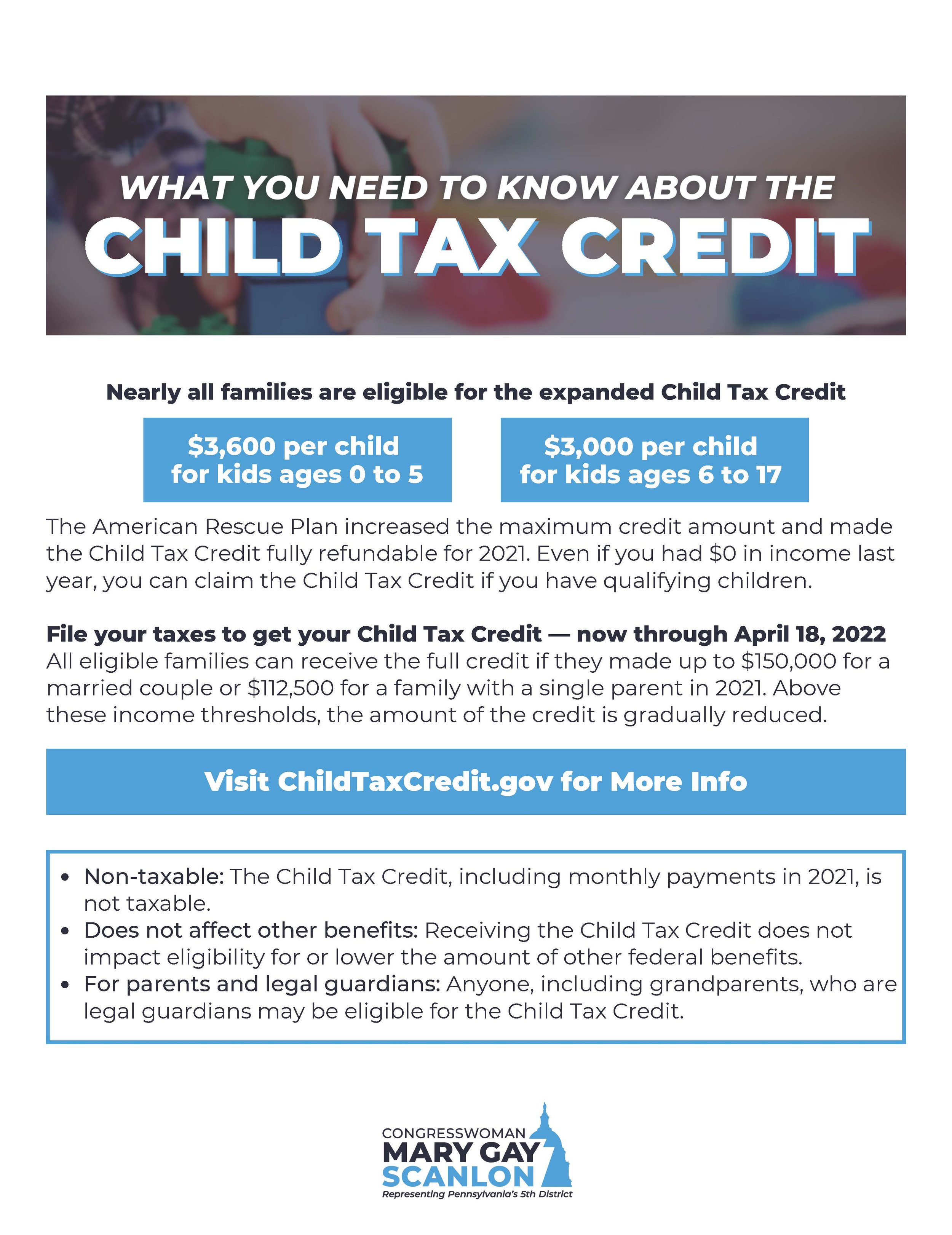

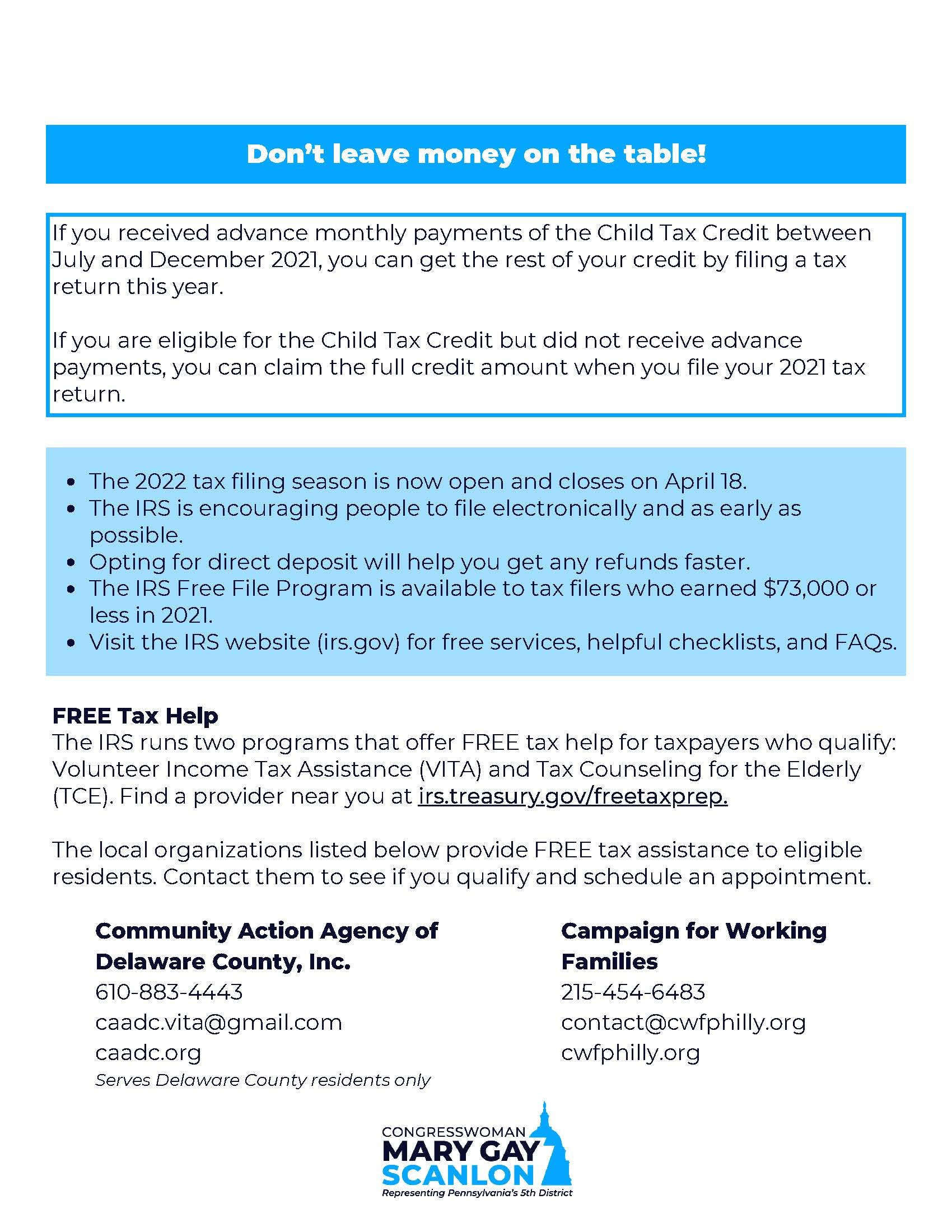

The American Rescue Plan, which became law in March 2021, provided a third stimulus check and three major tax cuts for working families, including transformational changes to the Child Tax Credit. It increased the maximum credit amount to $3,600 per child for kids ages 0-5 and $3,000 per child for kids ages 6-17. The economic relief bill also made the Child Tax Credit fully refundable for 2021 — meaning even families with $0 in income last year can claim the Child Tax Credit if they have children who qualify

Improvements made to the Child Tax Credit under the American Rescue Plan are currently only valid for tax year 2021, so it is more important than ever for families to claim the benefits they are entitled to.

More information: Child Tax Credit (U.S. government website) at childtaxcredit.gov

Resources for families to find free help for taxes

Internal Revenue Service (IRS) 2022 Low Income Taxpayer Clinic list, officially titled IRS Publication 4134, Low Income Taxpayer Clinic List

Campaign for Working Families:

‘Child and Dependent Care Tax Credit returns big dollars to your wallet

Free tax preparation - flyer

Community Legal Services of Philadelphia

United Way of Pennsylvania tax resources

Volunteer Income Tax Assistance programs in Pennsylvania (211): https://www.pa211.org/get-help/employment-expenses/vita-programs/

Bucks County

United Way of Bucks County: https://www.uwbucks.org/free-tax-prep-in-bucks-county/

Bucks County Opportunity Council (BCOC) Volunteer Income Tax Assistance: https://bcoc.org/tax-appointments/

Chester County

LTM VITA offers free tax preparation for low and moderate income households in Chester County.

Taxes are prepared by IRS-Certified Volunteers

No fees

Refunds with direct deposit

File online or drop-off services available

Services may be restricted by tax form and income

Locations include Coatesville, Downingtown, West Chester, Exton, Pottstown, Phoenixville, Royersford, Parkesburg and Landenberg

To learn more about locations, times, and what to bring, visit: ChesterCountyFreeTaxes.com.

Delaware County

Delaware County Government: delcopa.gov/ctc

Community Action Agency of Delaware County (CAADC)

Free Volunteer Income Tax Assistance (VITA) clinics, by appointment only: 610-833-4443. Sites include the CAADC Boothwyn Office in Boothwyn, Darby Court Apartments in Darby, and Lewis Crozer Library in Chester city.

Montgomery County

Call 211 or visit https://www.pa211.org/. You also can text your zip code to 898-211 to talk with a resource specialist for free.

Other resources

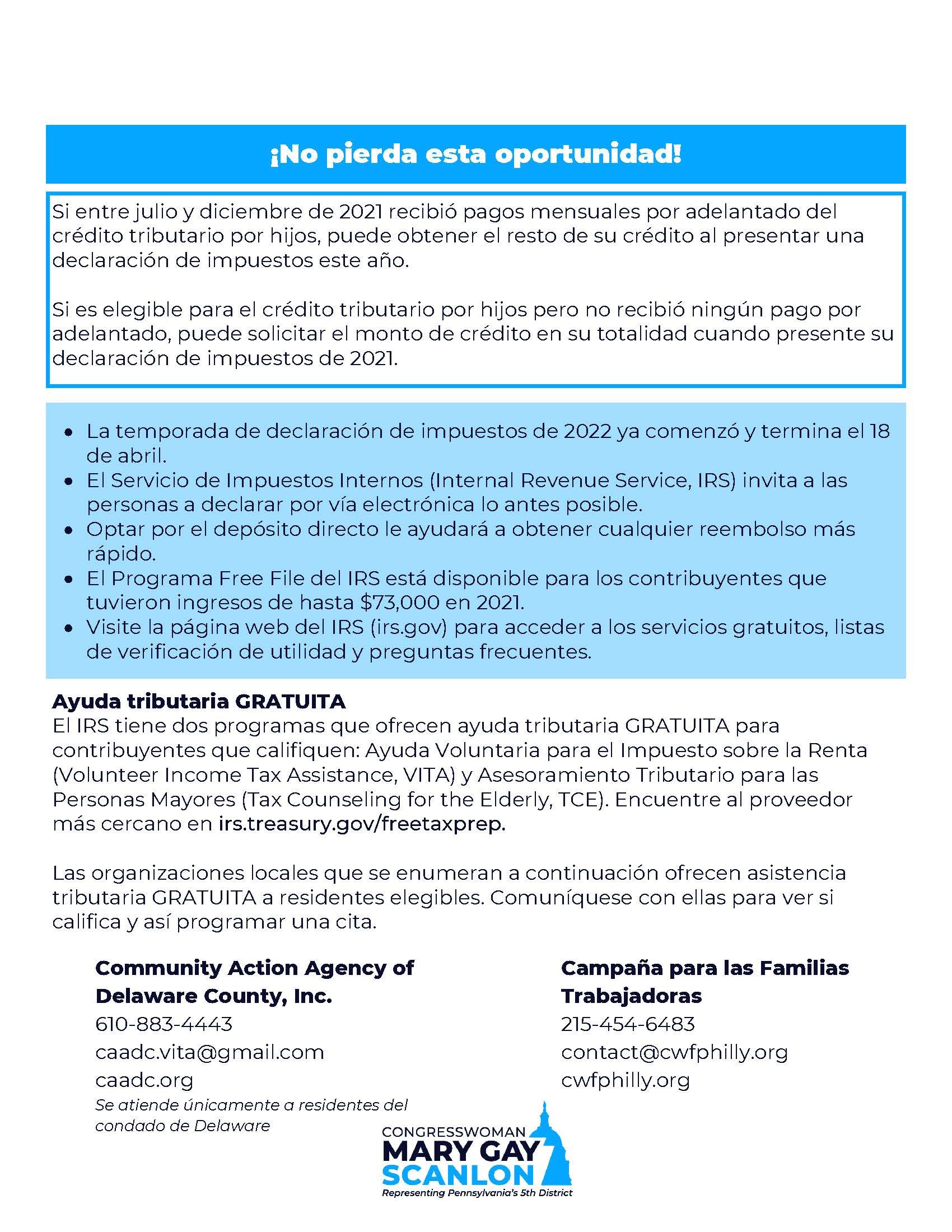

Informational Child Tax Credit flyers (shown above) from Rep. Scanlon’s office in six languages: English, Spanish, French, Simplified Chinese, Korean and Vietnamese:

Rep. Scanlon's press release on the Delco press conference and her Tax Help webpage provide additional tax tips and resources.

You may also be interested in:

LASP’s Pubic Benefits webpage: lasp.org/public-benefits