Chester County Mobile Home Tax Reassessment Project

(updated Jan. 28, 2024)

Legal Aid of Southeastern PA helps Chester County mobile home owners appeal their tax assessments. The project is a partnership with United Way of Chester County.

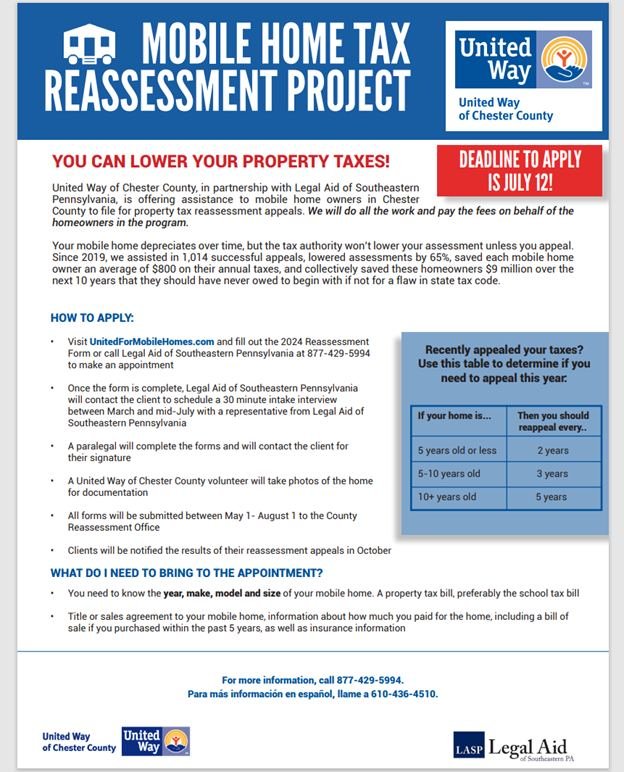

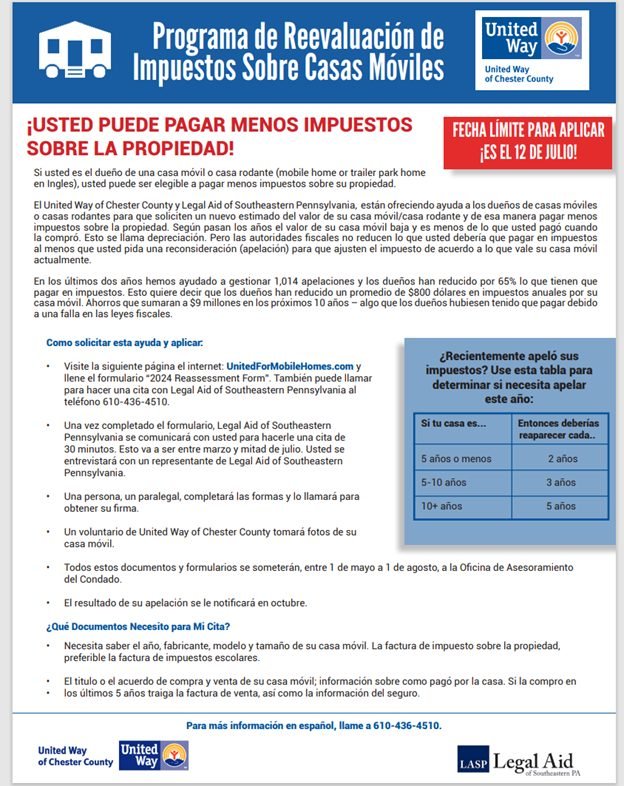

The 2024 project has started! Scroll down for information, links and flyers. Apply by Friday, July 12, 2024!

Volunteer attorneys, paralegals, law students and community members are invited. Scroll down for information.

Mobile home taxes

Mobile homes are overtaxed because they depreciate in value over time, and the Pennsylvania tax system does not automatically adjust the tax rates. The result? Many Chester County mobile home owners have been paying hundreds of dollars more in real estate taxes than they should owe every year.

Since 2019, Legal Aid of Southeastern PA and United Way of Chester County have partnered to provide free tax reassessments to Chester County mobile home owners. From 2019-2023, the project has resulted in 1,014 successful tax appeals, saving homeowners an average of 65%, or $800 per year, on their taxes. Altogether, mobile home owners will save nearly $9 million over the next 10 years.

Pro bono volunteer opportunity for attorneys, paralegals, law students & community members. Multiple opportunities are available. The project runs from February-summer 2024, and you do NOT need to volunteer for all months of the project. Volunteers are especially needed from May through the end of July. For more information or to volunteer, visit lasp.org/pro-bono and contact Brian Doyle, LASP Staff Attorney, at 610-436-4510, ext. 5210 or bdoyle@lasp.org.

How to apply for a 2024 reassessment

Application form and other information on the United Way of Chester County webpage: unitedwaychestercounty.org/our-impact/mobile-home-tax-reassessment.

Apply online or by phone:

Fill out this form at United Way of Chester County’s website.

Or call Legal Aid of Southeastern PA’s Helpline at 877-429-5994, Monday-Friday, 9 a.m.-1 p.m.

Deadline: Friday, July 12, 2024

What happens next

Legal Aid of Southeastern PA will contact you to schedule an intake appointment.

Or attend an in-person outreach. (Stay tuned! Outreach events will be added and also listed at lasp.org/events.

More details on how it works

Apply as soon as possible.

A representative from Legal Aid of Southeastern PA (LASP) will contact you between March and mid-July to schedule a 30-minute intake interview. The interview can be in-person, by phone, or by Zoom.

The paralegal will complete the forms and will need to get your signature.

A United Way of Chester County volunteer will take photos of the home for documentation.

Legal Aid of Southeastern PA will submit all forms to the Chester County Reassessment Office between May 1-Aug. 1.

Legal Aid of Southeastern PA provides free legal representation. You do not need to attend the county’s reassessment hearing.

You will get the results of the reassessment appeal in October.

This program is free.

United Way of Chester County pays the fees on behalf of the homeowners in the program.

Legal Aid of Southeastern PA provides free legal services.

Para más información en español, llame a 610-444-7750 opción 8.

Download the 2024 Mobile Home Tax Reassessment Project flyers in English and Spanish

(Updated Jan. 28, 2024)

The 2024 Mobile Home Project flyers are now available in English and Spanish! Click the buttons below to print, download and share the flyers.

Recently appealed your taxes?

Use this information to determine if you need to appeal this year:

If your mobile home is…Then you should re-appeal every…

If your mobile home is 5 years old or less, you should re-appeal every 2 years.

If your mobile home is 5-10 years old, you should re-appeal every 3 years.

If your mobile home is 10 or more years old, you should re-appeal every 5 years.

The photos show in-person outreaches and a volunteer training for the Chester County Mobile Home Tax Reassessment Project, a collaboration between Legal Aid of Southeastern PA, United Way of Chester County, and community partners.

Video Q&A

Questions and answers - in Spanish and English - on the Chester County Mobile Home Tax Reassessment Projec. Click here or image above to watch the 12-minute YouTube video from partner organization LCH Health.

Video in Spanish and English, from LCH Community Health, community partner

LCH Community Health created a 12-minute video about the 2022 Chester County Mobile Home Tax Reassessment Project. Watch it on YouTube: https://youtu.be/G_bebHiWLbo.

Have questions about the Mobile Home Tax Reassessment Program? Don’t wait! Get started with the application and save money. Call LCH (610) 444-7550.

¿Tiene preguntas sobre el Programa de reevaluación de impuestos para casas móviles? ¡No espere! Empiece a utilizar la aplicación y ahorre dinero. Llame LCH a (610) 444-7550.

Overall impact, 2019-2023

Since starting in 2019, Chester County Mobile Home Tax Reassessment Program has:

Assisted in 1,014 successful appeals.

Lowered the tax assessments for these 1,014 mobile homes by 65%.

Saved each mobile home owner an average of $800 per year on their taxes.

Collectively saved these mobile home owners $9 million over the next 10 years.

The project goal is to assist all mobile home owners in Chester County who may be in a similar situation.

Legal Aid of Southeastern PA and United Way of Chester County have worked together as partners on this project since its inception.

2023 project highlights

$1.7 million was reduced in taxes owed, translating to a savings of $799 per household per year.

Overall, households were over-assessed over 300%

2021 project highlights

The 2021 Chester County Tax Reassessment Project resulted in 246 successful appeals. The total tax reductions, beginning in 2022, will be $197,555.80, or an average of $803.07 per homeowner. The highest tax reduction will be $2,033.74, and the lowest tax reduction will be $35.48. On average, the mobile homes were overtaxed by 307.82%.

Project partners included Legal Aid of Southeastern PA, United Way of Chester County, LCH Health and Community Services (previously known as La Comunidad Hispana), and local food pantries.

Of 3,600 mobile homes in Chester County, only 21% have completed a tax reassessment as of 2021.

2020 project highlights

Legal Aid of Southeastern PA and United Way of Chester County helped 333 mobile home owners save $298,666.13 on their tax bills starting in 2021. The average savings on an individual homeowner’s bill was $896.90 per year.

2019 project highlights

The 2019 project helped 177 Chester County mobile home owners reduce their combined annual tax bill by $171,580.09. On average, mobile homes were overtaxed by $969.38.

Partnership between LASP, United Way of Chester County, Honey Brook Food Pantry and the Chester County Paralegal Association.

Further reading

United Way of Chester County’s webpage on the Tax Reassessment Project

In the Media

by Kelly Phillips Erb | Forbes | June 17, 2023 | https://bit.ly/Forbes-6-17-2023

United Way of Chester County Will Hold Outdoor Outreach Events for Mobile Home Tax Reassessment Program | MyChesco.com| May 17, 2022

Nonprofit Legal Services Help Homeowners Struggling With Property Taxes Keep Their Home - by Kristen Griffith | Chronicle of Philanthropy | Feb. 23, 2022

Tax Reassessment Appeals Helping Chesco Mobile Home Owners: United Way of Chester County hopes to help 500 mobile homeowners this year in filing for property tax reassessment appeals. By Marlene Lang | Patch.com | Feb. 21, 2022

How one quiet man’s efforts to help those in need in Chester County turned into a loud call to action by Chris Saello | Generosity Philly

Most mobile homes are overtaxed. Chester County owners are getting relief by Michaelle Bond | Philadelphia Inquirer | Sunday, Jan. 5, 2020

Anti-poverty crusaders fight to cut taxes for mobile-home owners: Low-income people who live in mobile homes in the Honey Brook area have been getting extra help that could allow them to stop overpaying property taxes by Alfred Lubrano | Philadelphia Inquirer | Aug. 11, 2018

LASP News

LASP and partners help 333 Chester County mobile homeowners successfully appeal taxes in 2020 during COVID (October 2020)

Chester County Mobile Home Tax Appeal project nears Aug. 3, 2020 filing deadline (July 2020)

177 of 177 successful tax appeals in 2019! YOU can help reach mobile home owners in Chester Co. in 2020 (December 2019)

Center for Rural Pennsylvania

Impact stories

Filing emergency appeal to save client's mobile home during COVID-19

Ms. C’s* LASP attorneys fought for her. They challenged an eviction in court and negotiated with the mobile home park owners.

Eventually, the owners agreed to allow Ms. C to return to her home. They accepted a repayment plan for the back rent she owed. Ms. C weathered the worst of the pandemic in her own home – instead of in a car or emergency shelter.

Ms. C weathered the worst of the pandemic in her own home – instead of in a car or emergency shelter.

*Name has been changed to protect confidentiality, but story is real.

Mary* inherited her mobile home after her mother passed away.

The home wasn’t big, but it was better than any of the apartments where she had lived in town, and it was hers. When Mary became disabled, she found her modest Social Security income wasn’t going to go far enough. Mary faced choices between food, electricity and heat, and her property taxes fell by the wayside. After a few years of struggling just to get by, she received a notice that her home would be sold at sheriff’s sale.

What Mary didn’t know was that a mobile home should be not taxed in the same way as other real estate. The value of a mobile home depreciates at a steady rate over time. Neither Mary’s mother, nor Mary, had ever appealed the county’s assessed value of her home. As a result, Mary had paid thousands of dollars more in taxes than if her home had been assessed fairly.

With the help of a LASP attorney, Mary appealed her property tax assessment. LASP also coordinated with expert volunteer attorneys to assist Mary in protecting her home from sheriff’s sale. As a result, Mary will no longer be faced with the cruel choice between providing herself with necessities or losing her home.

Sadly, Mary’s story is not unique. Hundreds of vulnerable residents of Chester County find themselves in similar situations. In 2019, LASP, along with United Way of Chester County and Honey Brook Food Pantry, helped 177 mobile home owners like Mary whose homes are being over-taxed. LASP, together with partner organizations, hope to help 1,000 more mobile home owners in 2020.

*Name changed to protect confidentiality.

Note: This story originally appeared in 2018-19 Annual Report (page 4).

You may be interested in:

Chester County Mobile Home Tax Reassessment Project